There is some thinking that the pace of the housing recovery is unsustainable and that we may be heading for another housing bubble. However, Jonathan Smoke, the Chief Economist of realtor.com explains the basic difference between 2005 and today:

“The havoc during the last cycle was the result of building too many homes and of speculation fueled by loose credit. That’s the exact opposite of what we have today.”

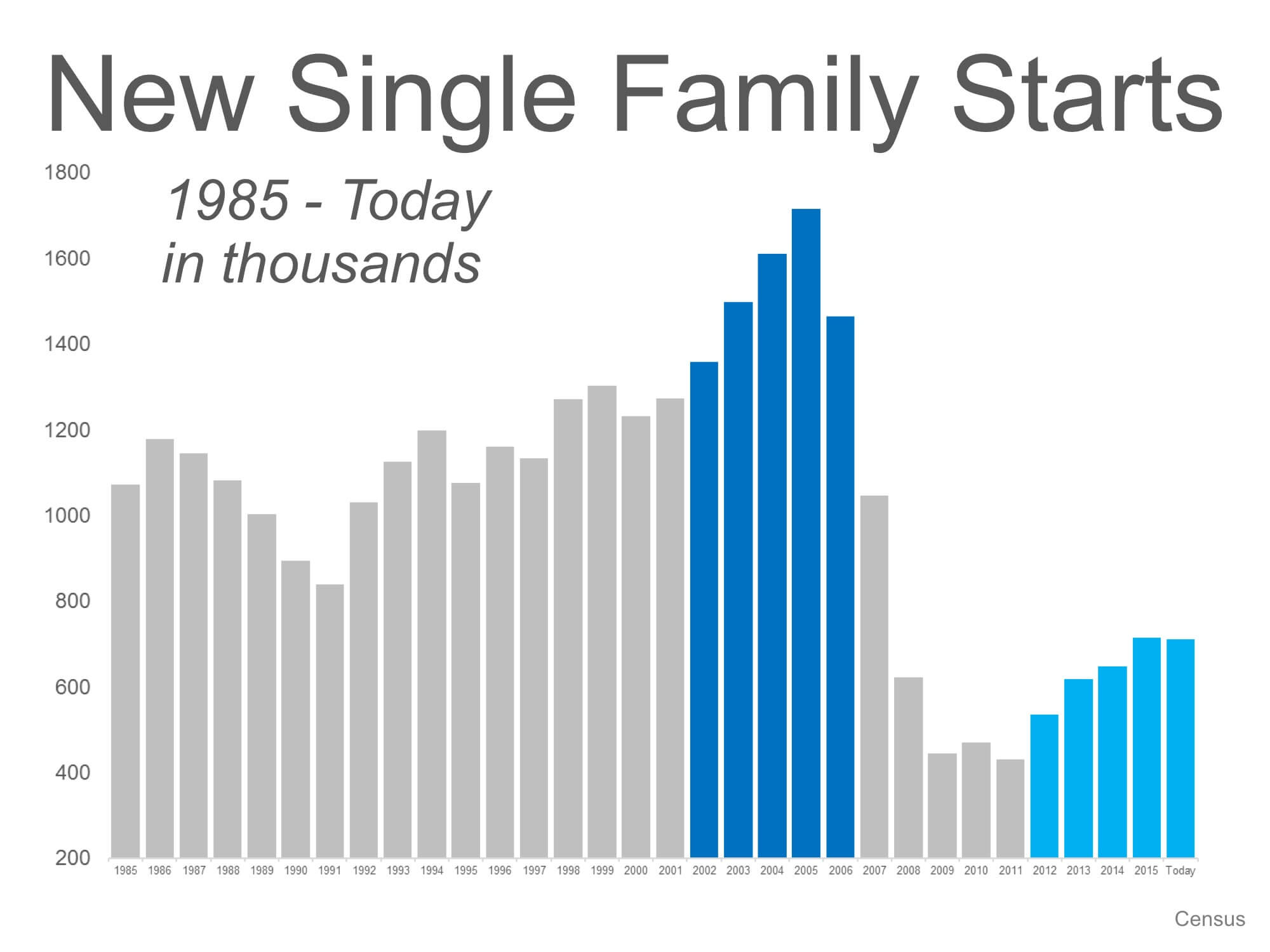

If we look at the number of new single family housing starts over the last 30 years, we can see that the numbers of housing starts during the current recovery (2012-Today) are still way below historic averages, and are far less than the numbers built during the run-up to the housing bubble (2002-2006).

A single family housing start is defined as “the number of permits issued for construction of new single family housing units. Housing starts are an important economic indicator due to its extensive spill over benefits for the other sectors of the economy (retail, manufacturing, utilities).”

Bottom Line

Current demand for housing actually calls for more new construction to be built – not less. We should at least return to historically normal levels.

Source: http://www.simplifyingthemarket.com/en/feed/?a=217019-f2452a8f8cdc42dd481fd452124719d3