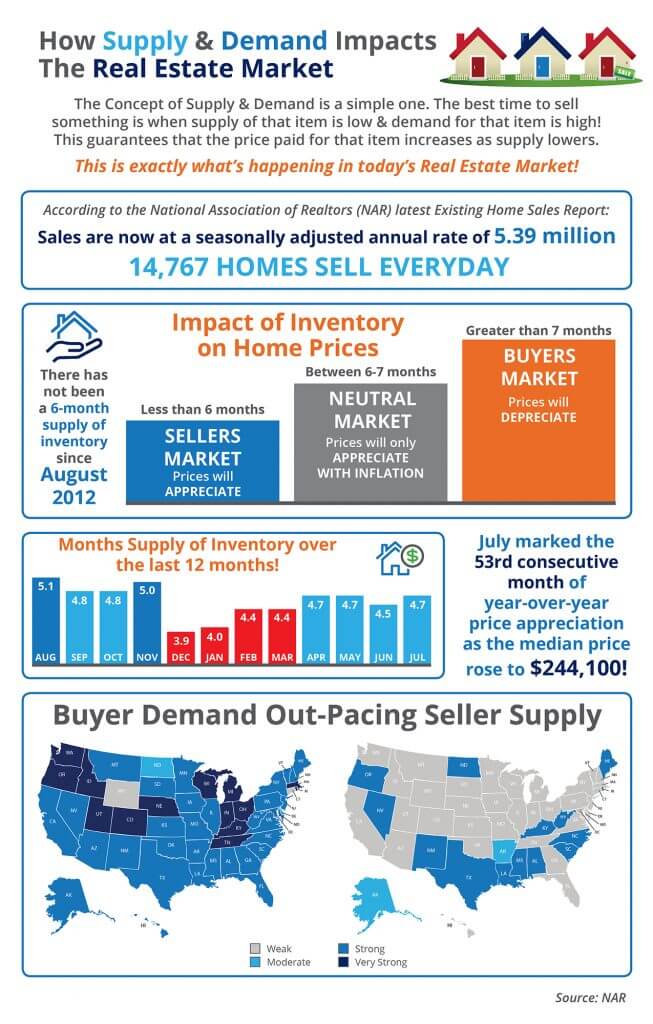

Some Highlights: The concept of Supply & Demand is a simple one. The best time to sell something is when supply of that item is low & demand for that item is high! Anything under a 6-month supply is a Seller’s Market! There has not been a 6-months inventory supply since August 2012! Buyer Demand […]